Foreign Currency Accounting in Spire

Background

Foreign currency accounting in Spire is designed to satisfy the generally accepted accounting principles in Canada as set out currently by the CPA (Chartered Professional Accountant) standards:

For bank balances, accounts receivable and accounts payable:

At each balance sheet date, monetary items denominated in a foreign currency shall be adjusted to reflect the exchange rate in effect at the balance sheet date.

For sales, purchases, inventory and fixed assets:

Once foreign currency purchases and sales, or inventories, fixed assets and other non-monetary items obtained through foreign currency transactions have been translated and recorded, any subsequent changes in the exchange rate will not affect those recorded amounts.

Currency set up in Spire

There are three aspects to currency setup in Spire:

- Edit/Currencies where, for each currency, the currency is configured, the current exchange rate is established, as well as rates for each prior month

- GL account, Customer and Vendor – each of these can be designated with a specific foreign currency

- GL/Accounts/Revalue, which evaluates all monetary items (bank, A/R, A/P) denominated in a foreign currency at specific dates and calculates a G/L adjustment to bring the balances to the rate in effect on that date; the differences are booked immediately to the asset account and offset against the gain or loss on currency exchange account

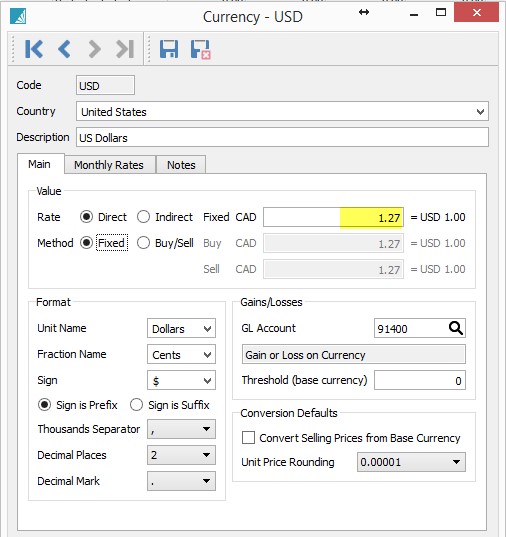

Edit / Currencies

This is where currencies are established and configured, and where current and monthly exchange rates are set up.

The highlighted rate is the current rate; click on the Monthly rates to see the historical rates.

GL Account, Customer and Vendor currency setup

These default to Canadian when first set up, but can be changed to one of the currencies established in Edit / Currencies.

General Ledger:

Customer (Billing tab):

Vendor (Billing Tab):

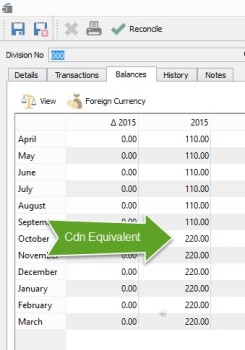

Underlying Structure of GL Transactions

The foreign denominated General Ledger accounts, Accounts Receivable and Accounts Payable are all maintained in the foreign currency as well as Canadian dollars; for every foreign currency entry, there is both a Canadian dollar journal entry as well as a foreign currency journal entry.

The important balance is the foreign currency balance for accounts denominated in a foreign currency since it is derived from the actual transactions such as sales, cash receipts, purchases and payments. The Canadian balance is merely the calculated equivalent.

For current transactions, the system uses the current exchange rate to record the Canadian equivalent; for transactions in a prior period, the system uses the rate for that period. If a rate has not been entered, it uses the current rate. Users can also set the exchange rate for specific transactions.

Currency Revaluation

GL accounts, in addition to having a currency designation, also have a flag for whether an account is to be revalued or not.

Bank accounts, Accounts Receivable, Accounts Payable and other monetary accounts (US GIC’s, perhaps) should be flagged as ‘Revalue’. All income statement accounts as well as capital asset accounts should not be so flagged. Note that inventory is only maintained in Canadian dollars even though inventory vendors might be from the US or elsewhere.

The revaluation routine only affects those accounts flagged as ‘Revalue’.

The revaluation routine calculates the Canadian dollar equivalent of any foreign balances flagged as ‘Revalue’ using the exchange rate set for the period end date, and then it compares it to the Canadian amount previously calculated. The difference results in an unrealized foreign currency gain or loss; the other side of the journal entry is to the asset account.

To run the revaluation routine, click on the Revalue icon when on the Accounts tab of the General Ledger.

You can revalue individual accounts or all accounts at once; you can revalue for the current date or for any date in the past. Most companies would typically revalue once a month at month end.

Checking Results after Revaluation

Bank:

Go the GL, Balances tab for a US account. Toggle the currency. Take the US amount, multiply it by the rate for the period; toggle the currency back to Canadian; you should get the Canadian equivalent.

Accounts Receivable and Accounts Payable

Print the Aged Listing for the month end date. The US and other currencies will have their own sub-totals.

Go to the related A/R or A/P balance in the GL. Toggle the currency. The balance in the account should equal the listing. (For example, the US portion of the Accounts Receivable listing should equal the GL balance for US Accounts Receivable, as viewed in US$)

Take the foreign currency total, multiply it by the exchange rate at the end of the period. The total should equal the balance in Canadian dollars for that account.

Related Topics

This document provides a high level view as to the structure of foreign currency transactions in Spire.

Other things to consider include:

- how often the currency revaluations and rollups should be run

- what rates to set in the currency manager to minimize gains and losses

- price lists that need to be maintained in a foreign currency

- vendor pricing in foreign currencies

- how to book bank transfers between foreign currency and Canadian accounts

Please do not hesitate to contact me for further guidance regarding foreign currency in Spire at rita.bloem@rogers.com.